Batteries light the way to renewable energy but the IEA is missing it

Stationary batteries are getting ridiculously cheap. They will make it relatively easy to transition to 100% solar and wind. They will also make the grid more resilient and eliminate blackouts and voltage fluctuations.

Most people currently managing the grid fail to wrap their heads around this. They can’t imagine the accompanying change from a centrally managed top down grid to the decentralized and bottom-up grid that will result from renewables plus batteries. A vivid example given in this post is the underestimation of batteries by the IEA.

Introduction and IEA solar predictions

My entire professional life I’ve made my living predicting technological innovations and then getting to work on them. First as a self employed project leader in the Telecom sector (PCs, TCP/IP, WWW, mobile phones, smart phones) and since my sabbatical fifteen years ago it’s been about renewable energy and electric vehicles at the Eindhoven University of Technology (where I started a research initiative) and with my simulation company Zenmo.

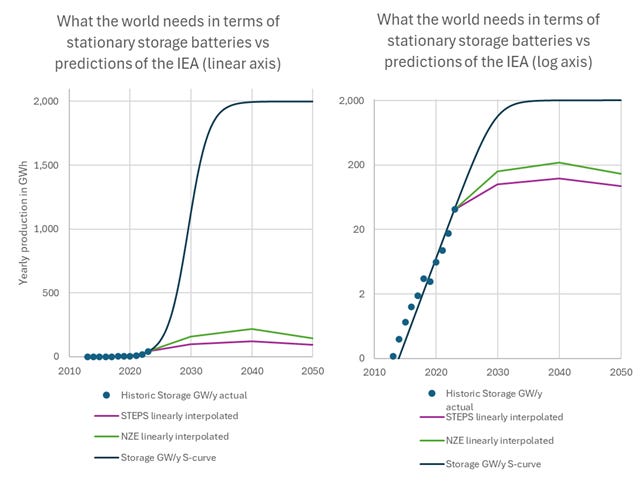

This sabbatical was actually the result of a discovery I made regarding the underestimation by the IEA of the growth in solar panels. That made me want to dive in (even though I ended up writing a book on electric vehicles to start with). The picture below visualizes the discovery that changed my career gave me some notoriety on twitter: the thick black line shows the actual growth of solar and the horizontal colored lines show the assumptions about the future of the IEA.

What made the picture pop is that I translated the numbers of the IEA to what that meant for the solar factories popping up everywhere. I still have the suspicion that the people at the IEA were not accustomed yet to the fact that a solar panel lasts 25 years instead of being burned and lost in an instant like coal, oil and gas. Or maybe it is just the perennial inability of people to understand exponential growth.

The chart shows that the IEA predictions implied that the solar sector would stop growing suddenly after the year in which they made their prediction. And they predicted that year after year after year. Now I’m going to show you the same problem in their first report on batteries.

(Note: the 2023 production of solar panels is estimated at 447 GW. That is ‘off the chart’ times three. And the predictions of the IEA still can’t catch up. Although I also agree with this defense.)

IEA battery predictions

I started with the new 2024 IEA battery report. Although I will complain about the predictions of future growth, it is an excellent resource of information on what is happening on the battery market. If they got the predictions right it would be almost perfect.

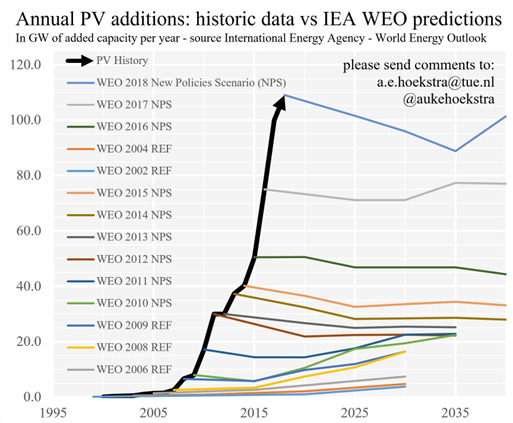

Let’s start with the actual historic developments vs the predictions of the IEA.

The graphs shows the historic developments (the dots) and the predictions of the IEA in the “business as usual” scenario STEPS and in the “let’s do everything we can to reach Net Zero Emissions” scenario NZE. The graph on the left has a regular linear vertical axis. There it doesn’t look so strange.

But on the right I used a logarithmic vertical axis and there you can see something strange is going on. The historic developments form an almost perfect straight line (except for a little problem during the COVID crisis). The straight on a logarithmic chart indicates exponential growth. I fitted an exponential growth curve to the historical data and I got a yearly growth 0f 62% that fitted the data almost perfectly. The IEA predicts a sharp break that is impossible to fit. What gives?

My first thought was: the battery market is simply getting saturated. I mean, that is what the chart suggests. But is it?

How much batteries do we need?

I’m only looking at stationary batteries here. (The market for electric vehicles is roughtly 10x as big but I will ignore that for now.) I will also make very rough and simple to follow calculations.

In the NZE scenario the IEA expects a final energy demand of roughly 100 000 TWh per year in 2050. Assuming we get all that from renewable energy this would mean an average production of 10 TW (=terawatt). That’s roughly 1 kW per person by the way.

Scenarios for renewable energy systems often assume around 5 hours of batteries. So that would be 50 TWh (or 5 kWh per person). (A nature article from 2019 by my friend Christian Breyer arrived at 48 TWh so we are definitely in the ballpark here.)

Assuming we replace the batteries every 25 years that means we will end up installing 2 TWh per year after 2050.

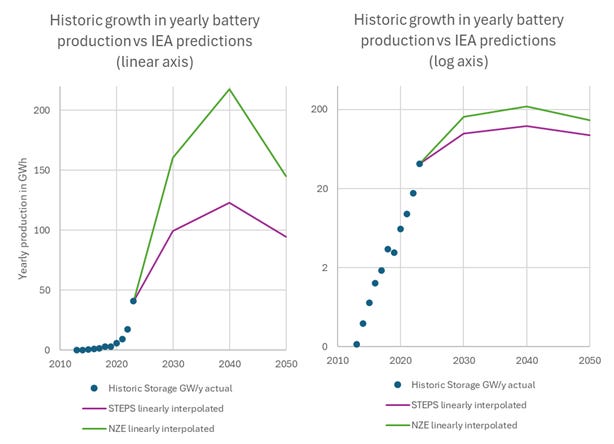

So what I did was fit an S-curve (aka logistic function) to the historical data that would arrive at 2 TWh per year after 2050. That way we simulate the usual development of a market that grows exponentially at first but then saturates as it reached full market potential.

I got a curve with a 59% growth rate and midpoint in 2033 that fits the data with 99.8% precision (R2). That’s an almost bloody perfect fit to the historical data that arrives at an endpoint in line with the research. I’ll take it.

Now let’s compare that combination of past developments and future needs to the IEA predictions.

On the left you see the S-curve I determined based on past exponential growth and future demand in a renewable future. It’s racing towards 1000 GWh per year around 2030 and then slows down to reach 2000 GWh per year around 2040.

You also see that the IEA basically throws in the towel before the race to provide the world with enough batteries has even begun. This is not a believable prediction of business as usual (STEPS) or an an all out zero emission scenario (NZE).

I’m sorry, but I cannot come up with a satisfactory explanation for what the IEA predicted here. (Other than scepticism of change.) This is so much below what is needed and below where the historical trend is pointing that it’s basically a data crime.

Will these batteries brake the bank?

We don’t know how the IEA got to its predictions because it’s models are a secret, but in the past the lack of uptake of solar has often been blamed on unrealistic price assumptions.

Might high prices be the problem here? Let’s find out.

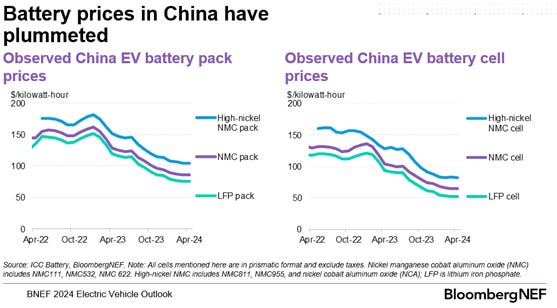

First let’s determine a starting price per battery. In 2024 the price of LFP batteries is around $65/kWh on the wholesale pack level (see picture) and since sodium batteries are already being installed and are supposed to be cheaper I’ll conservatively assume they cost the same.

To determine how much they will cost in the future we have to calculate the learning curve. We know that batteries on average become 25% cheaper for every doubling of cumulative production volume (see my previous substack post for details). So how much will production of sodium batteries increase?

I start with the assumption that currently there is about 10 GWh of new sodium batteries. The first large factory is being build in 2024 and is planned to eventually produce 30 GWh per year but that is still one or two years off. So 10 GWh is a rough estimate but that can’t be helped.

I assume we stop learning in 2034 when we have roughly 10 000 GWh of stationary batteries (cumulative, not per year) and I assume that half of them (5 000 GWh) are sodium batteries. Going from 10 to 5 000 is over 9 doublings. Subtracing 25% nine times from a price of $65/kWh would result in a price of $6.5/kWh.

That seems insane but in the previous substack post I already described how sodium batteries can have a ridiculously low material costs of around $1/kWh if you buy the raw materials directly from the mine. So raw materials won’t be the issue.

Let’s round up to $10/kWh.

We want to end up with 50 TWh which is 50 billion kWh at $10/kWh or $500 billion total. That sounds like a lot but we spend over 5 trillion a year on energy so over the period to 2050 this is less than 0.5% of our global energy bill.

Replacements every 25 years would increase the price per kWh with… 0.02 cents. You read that right. So even if my calculations are 5x too optimistic we are talking about massive amounts of batteries costing less than 0.1 cent per kWh.

One kWh battery per kWp of solar panels

An interesting heuristic I came up with is that we should install 1 kWh of batteries for every kilowattpeak (kWp) of solar panels. On average solar panels will output around 20% of their rated peak power worldwide (see table). A good rule of thumb is that you want a minimum of 5 hours of storage in the future renewable grid. Five times 20% is 100%, hence 1 kWh of batteries for 1 kWp of solar panels.

I think buying batteries with your solar installation will become as normal as buying an inverter. And not that expensive either. Solar panels cost at least $100 per kWp wholesale and an entire system can easily cost $1000 per kWp. Adding a matching battery of $10 or even $100 so you can get more out of your system seems only prudent.

A brand new electricity grid

I’m becoming convinced that we are moving towards an abundance of cheap batteries. You will be able to buy them as standard 4 kWh (25 kg) blocks the size of a sack of sand that are easy to place by one person and can be connected up to any desired size. Grid operators will use 20 foot containers with 5 MWh per container that can be stacked if room is an issue.

First these batteries will make it easy to get 100% of energy from cheap solar and wind.

(Caveat: we still have to combine it with seasonal storage using e.g. hydrogen or other electro-fuels for the last 5% or so, because batteries will always be expensive for storing seasonal fluctuations. But since that’s only 5% of our energy flows it will not break the bank.)

But these batteries will do so much more. They will also make our grids more resilient by making blackouts impossible and by largely eliminating fluctuations in current and voltage. Just the grid reinforcements that we avoid this way will pay for the batteries.

I envision solar homes everywhere that could run on batteries without a grid connection for a few hours (and get more electricity using their electric car every other day when the outage lasts longer). Solar buildings combine to form solar neighborhoods that combine into solar countries. With every step grid costs are minimized and resilience is maximized.

I’ve made a profession out of being one of the first to see new technologies coming but I must be honest: although it seems logical to me and it is where the data points me, I still have to get used to this seismic shift. Fortunately it is a very wholesome seismic shift. So I hope I’m right.

Pleased to see S-curves rather than mistaking them for exponential, even if they do look alike at first. We want solutions that top out.

As an Australian I saw a grid battery installed to widespread derision just 7 years ago, that became operational within 6 months of contracts signed, that has both aided grid reliability and earned excellent returns on investment since. Whole battery factories have been built and have already added 20X more battery storage than that to Australian grids (and vastly more elsewhere) since then, all of it getting progressively cheaper.

To some extent using grid batteries has been out of expedience - quick fixes more than deep planning. Yet it seems to me even relatively small amounts have a big impact long before we can see a full sufficiency of storage. Enough to carry solar overnight on an every sunny day basis will impact gas peakers for example.

I had thought we'd be looking to pumped hydro for the long deep storage part - emerging industry confidence that wind and solar would grow enough to need it leading to investments in it - and some are in the pipeline. Yet the cost effectiveness of batteries keeps improving and the potential for cost effective long deep storage using them may see a bit more wait and see. Which just makes adding batteries in the meantime - expedience - more attractive.

Batteries, like wind and solar before them have crossed cost thresholds that mean nothing will be same ever again. I think the US is probably doing a bit of catch up compared to RE, especially solar, in Australia - but will do it much cheaper and quicker.

Auke Hoekstra's article presents an optimistic view of the role that stationary batteries will play in transitioning to a 100% renewable energy grid. While his analysis is compelling, there are several areas where he may have overlooked complexities or made overly simplistic assumptions:

1. **Overestimation of Cost Reductions**:

- **Learning Curve Limitations**: Hoekstra assumes a continuous 25% cost reduction for every doubling of cumulative production, leading to battery costs as low as \$10/kWh. This projection may not account for diminishing returns as technologies mature. Manufacturing efficiencies and material cost reductions often plateau, making such steep declines less likely in the long term.

- **Material Costs and Scarcity**: Even with abundant materials like sodium, the costs associated with extraction, processing, and manufacturing at scale might not decrease as rapidly as anticipated. There could be unforeseen expenses related to supply chain logistics or raw material purity requirements.

2. **Technical and Practical Challenges with Sodium Batteries**:

- **Performance Limitations**: Sodium-ion batteries are less energy-dense than lithium-ion batteries, which could limit their applicability or require larger physical spaces for the same storage capacity.

- **Commercial Viability**: The technology is still emerging, and there may be technical hurdles that delay mass production or affect longevity and reliability compared to established lithium-based technologies.

3. **Underestimation of Infrastructure and Grid Integration Challenges**:

- **Grid Management Complexity**: Transitioning to a decentralized, bottom-up grid introduces significant technical challenges in grid management, balancing supply and demand, and ensuring stability. Advanced grid management systems and protocols need to be developed and widely adopted.

- **Regulatory and Policy Barriers**: Changes in grid structure require supportive policies and regulations. The transition may face resistance from established utilities and require significant legislative efforts.

4. **Assumption of Continuous Exponential Growth**:

- **Market Saturation**: Exponential growth is not sustainable indefinitely. Market saturation, decreased demand growth, or alternative technologies could slow the adoption rate of batteries.

- **Economic Factors**: Economic downturns, changes in investment trends, or shifts in energy prices could impact the growth trajectory of battery installations.

5. **Simplification of Storage Requirements**:

- **Adequacy of 5 Hours of Storage**: The assumption that 5 hours of storage is sufficient may not hold in all contexts. Regions with less consistent renewable energy generation or higher peak demands might require more extensive storage solutions.

- **Seasonal Variability**: Hoekstra acknowledges the need for seasonal storage but suggests it represents only about 5% of energy flows. This might underestimate the complexity and scale of seasonal fluctuations in renewable energy availability, especially in regions with significant seasonal variation in sunlight or wind.

6. **Battery Lifespan and Replacement Costs**:

- **Realistic Lifespan Estimates**: Assuming a 25-year lifespan for batteries may be optimistic. Factors such as depth of discharge, operating temperatures, and charging rates can significantly affect battery degradation.

- **Environmental and Economic Costs of Replacement**: Regular battery replacements involve not only economic costs but also environmental impacts related to manufacturing and recycling or disposing of old batteries.

7. **Environmental and Social Impacts**:

- **Resource Extraction**: Scaling up battery production requires substantial increases in mining activities, which can have environmental and social consequences, including habitat destruction, water pollution, and community displacement.

- **End-of-Life Management**: The article does not address the challenges associated with recycling or disposing of large volumes of batteries at the end of their useful life.

8. **Consumer Adoption and Behavior**:

- **Willingness to Invest**: The assumption that consumers will readily adopt home battery systems may overlook economic barriers or lack of incentives, especially in lower-income households or regions without supportive policies.

- **Education and Awareness**: Successful integration of decentralized storage requires consumer understanding and acceptance, which may require significant education and outreach efforts.

9. **Competition from Alternative Technologies**:

- **Other Storage Solutions**: Technologies like pumped hydro, compressed air energy storage, or emerging storage solutions might compete with batteries, potentially affecting market dynamics and adoption rates.

- **Advancements in Grid Management**: Improvements in demand response, energy efficiency, and grid interconnections could reduce the reliance on battery storage.

10. **Overlooking Geopolitical and Supply Chain Risks**:

- **Supply Chain Vulnerabilities**: Global events, trade disputes, or supply chain disruptions could affect the availability of materials and components necessary for battery production.

- **Dependence on Specific Technologies**: Relying heavily on a single technology type may introduce risks if unforeseen challenges arise with that technology.

11. **Financial and Investment Risks**:

- **Upfront Capital Costs**: The initial investment required for widespread battery deployment is substantial. Securing financing and ensuring equitable access could be challenging.

- **Return on Investment Uncertainties**: Fluctuating energy prices and regulatory changes can affect the financial viability of battery investments for consumers and utilities.

12. **Assumption of Global Homogeneity**:

- **Regional Variations**: The feasibility of the proposed battery and renewable energy integration may vary widely between countries and regions due to differences in climate, economic conditions, infrastructure, and regulatory environments.

- **One-Size-Fits-All Approach**: A universal solution may not address specific local challenges, such as urban density constraints, land availability, or cultural factors affecting energy use.

In summary, while Auke Hoekstra presents an encouraging outlook on the potential of stationary batteries to revolutionize the energy grid, there are several areas where his analysis might benefit from a more nuanced consideration of the complexities involved. Addressing these factors would provide a more comprehensive understanding of the challenges and opportunities in transitioning to a fully renewable and battery-integrated energy system.